Pitching

The Hidden Choice in Every Startup Pitch

Should you start your pitch with your big, most impressive vision? Or something a bit more attainable, and then present the big vision later in the deck? Here's how to decide.

Otto Pohl

Jan 20, 2026

Share this post

Here’s a common startup dilemma: you’re launching with a focused use case, but you believe it unlocks a much bigger market. Do you lead with the big vision for maximum impact—or start narrow and ladder up?

Most early-stage narratives have three beats that pertain to markets:

The market affected by the problem you describe,

The first vertical you go after, and

(Often, not always) the broader market opportunity that first win enables.

I call that last one the Moment To Dream (MTD)—the slide where, after you’ve made your core pitch, you hit investors with the “but wait, there’s more” story about the real opportunity.

There’s no one-size-fits-all answer regarding the best order in which to describe these opportunities. A few questions to help you decide:

• Which idea is easier to believe today—the big vision or the first market?

• Is your initial market venture-scale (roughly $1B+ or a plausible path to $100M ARR)?

• Is the big vision exciting—but still plausible and reasonably near-term?

• Is the vision indivisible? (For Airbnb’s seed pitch, for example, the entire concept of home-sharing was an MTD.)

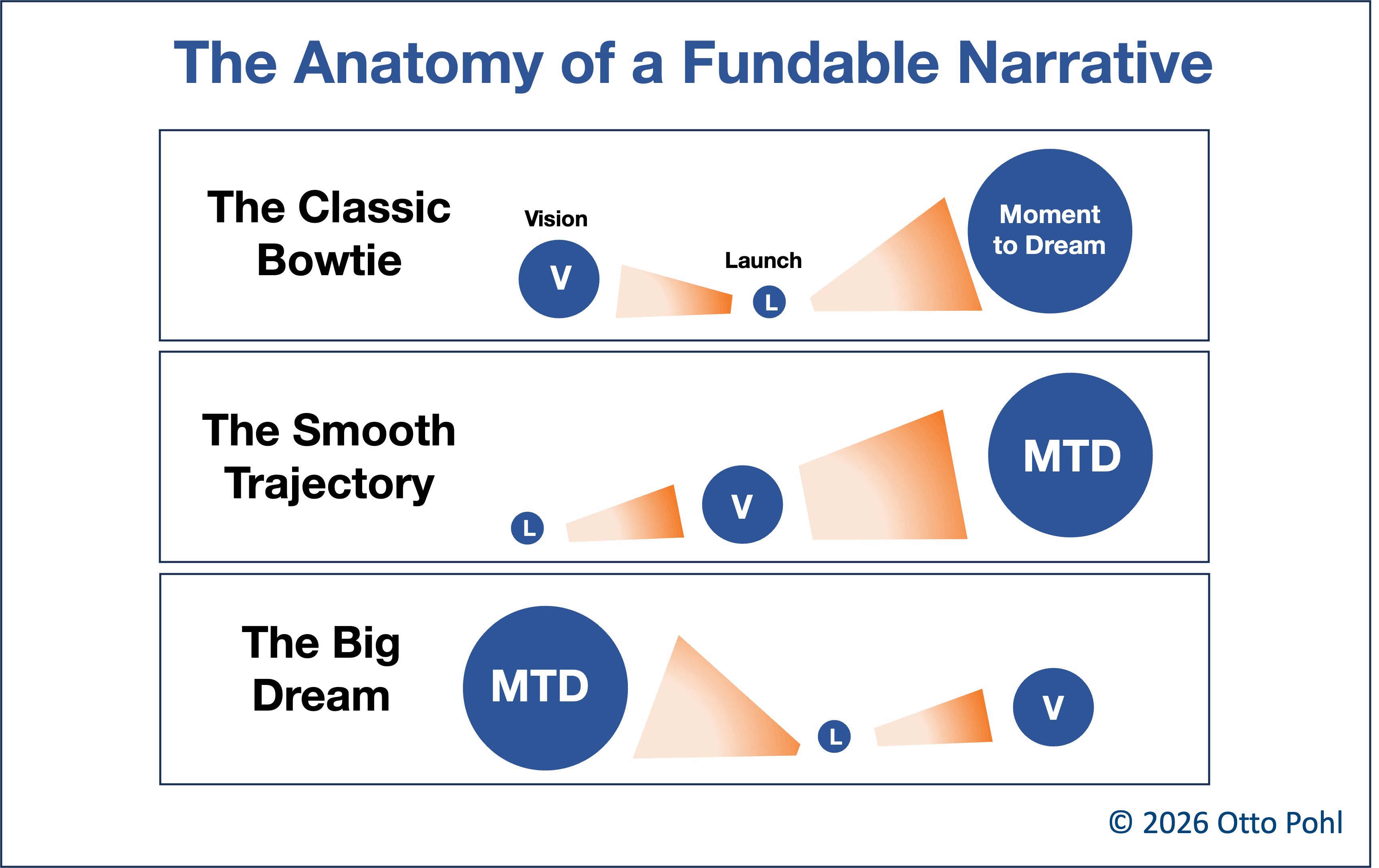

The three beats can be rearranged as follows:

The Classic Bowtie

This fits 80% of decks I see. You anchor the story in a clear, investable first market, then widen to the bigger platform opportunity.

I reviewed a deck for a company developing an $8B immunosuppressant drug using genetic engineering. Once that drug launches—initially via pharma partnerships—the same manufacturing platform enables dozens of additional drugs. Just as investors get excited about the first $8B market, you reveal the $75B+ expansion. That’s a textbook Bowtie.

Often founders forget the MTD. Big mistake. I worked on a deck for a company that developed a protein spray to improve bone-metal grafting rates in spinal fusion surgery. Is there anything special about the titanium used in spinal fusions? I asked. Nope. So why can’t you improve the success rates of every implant operation? Sure, they said. Perfect MTD.

The Smooth Trajectory

If you have impressive traction, lead with it.

I’m working with a company that simplifies sample prep for trace-level testing—detecting tiny impurities in food or aroma molecules in perfume. Despite being early, they’re already working with one of the world’s largest wine companies. We open with that traction, expand to agriculture, then land the MTD: every industry that relies on trace-molecule analysis.

The Big Dream

Sometimes the technology is so radical that you want to showcase the future first.

I recently worked on a pitch for “Industrial Velcro” strong enough to hold houses together. Rather than start with a single application, we opened with a world where construction can be as easy and fast as Legos—and then described applications such as building military bases, refugee camps, or developing-world housing.

I saw a different version of the Big Dream pitch structure with a company tracking radioactive tritium in groundwater. Nuclear power is the only near-term opportunity, but fusion was the real vision. Even though fusion isn’t commercial yet, pitching the product for the nuclear industry felt flat, even if it will be the first (and only near-term) customer. So we started with the dream to help fusion and then positioned nuclear as the GTM.

Repackage?

I recently had a company that started its pitch about how they plan to revolutionize the organ transplant market with lab-grown organs. Yet that’s clearly the MTD. For now, they’re making tiny tissue samples that can be used for in-vitro testing—only then will they grow veins for vascular grafts, and finally full lab-grown organs. We could have gone Bowtie (Vascular grafts-->tissue samples-->organs) but they saw organs as their true mission. So we positioned veins and organs as two parts of the “lab-grown replacement” market, where we start with the tissue samples, then do veins, and then do organs. That allowed us to mention organs up front as an integral part of a long-range plan.

What about your pitch?

There’s no formula—only case-by-case decisions. If you’re struggling to optimize the order of your market story, let’s talk it through.

Share this post

Otto Pohl is a communications consultant who helps startups tell their story better. He works with deep tech, health tech, and climate tech leaders looking to create profound impact with customers, partners, and investors. He has taught entrepreneurial storytelling at USC Annenberg and at accelerators across the country.